Eligibility Criteria for SME IPO and the flow from Basic to Advanced

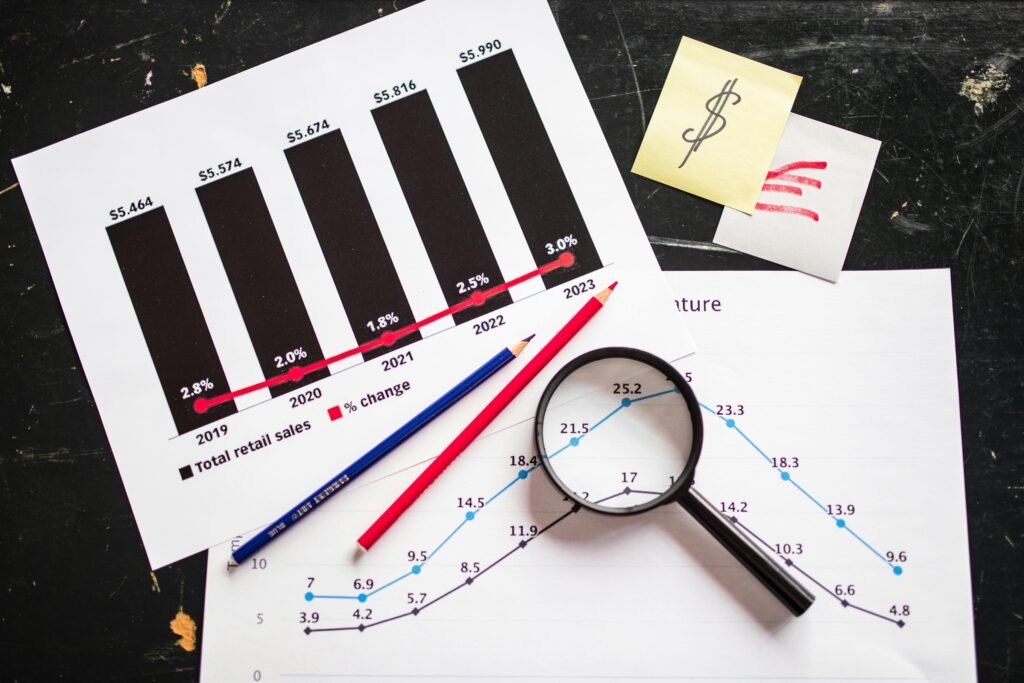

SMEs account for ~30% of India’s GDP, 45% of manufacturing output, and 40% of exports, while employing over 110 million people. Key sectors include textiles, food processing, engineering, and handicrafts. The Indian government supports SMEs through schemes like MUDRA Loans, Credit Guarantee Fund Trust for Micro and Small Enterprises (CGTMSE), and Udyam Registration for easier compliance.

Despite challenges like limited access to credit and technology, SMEs are vital for Make in India, Atmanirbhar Bharat, and rural development. With digital transformation and GST reforms, India’s SME sector is poised for growth, driving innovation and inclusive economic progress.

Why SME IPO introduced?

SMEs are vital to India’s socio-economic development, contributing significantly to employment and innovation. As of 2022, there were approximately 75 million SMEs, expected to grow to 95 million in the coming years. To address their capital needs, SME IPOs were introduced in 2012, with dedicated platforms like BSE SME and NSE Emerge offering relaxed regulatory norms compared to main board IPOs. These platforms have seen robust activity, with 587 companies listed on NSE Emerge and around 600 on BSE SME, collectively raising over ₹23,645 crore by early 2025.

Eligibility Criteria for SME IPO

The eligibility criteria ensure that only financially stable and operationally sound SMEs can access public markets. These criteria are governed by SEBI regulations and further specified by the stock exchanges. Below is a detailed breakdown:

Common Eligibility Criteria (Applicable to Both BSE SME and NSE Emerge)

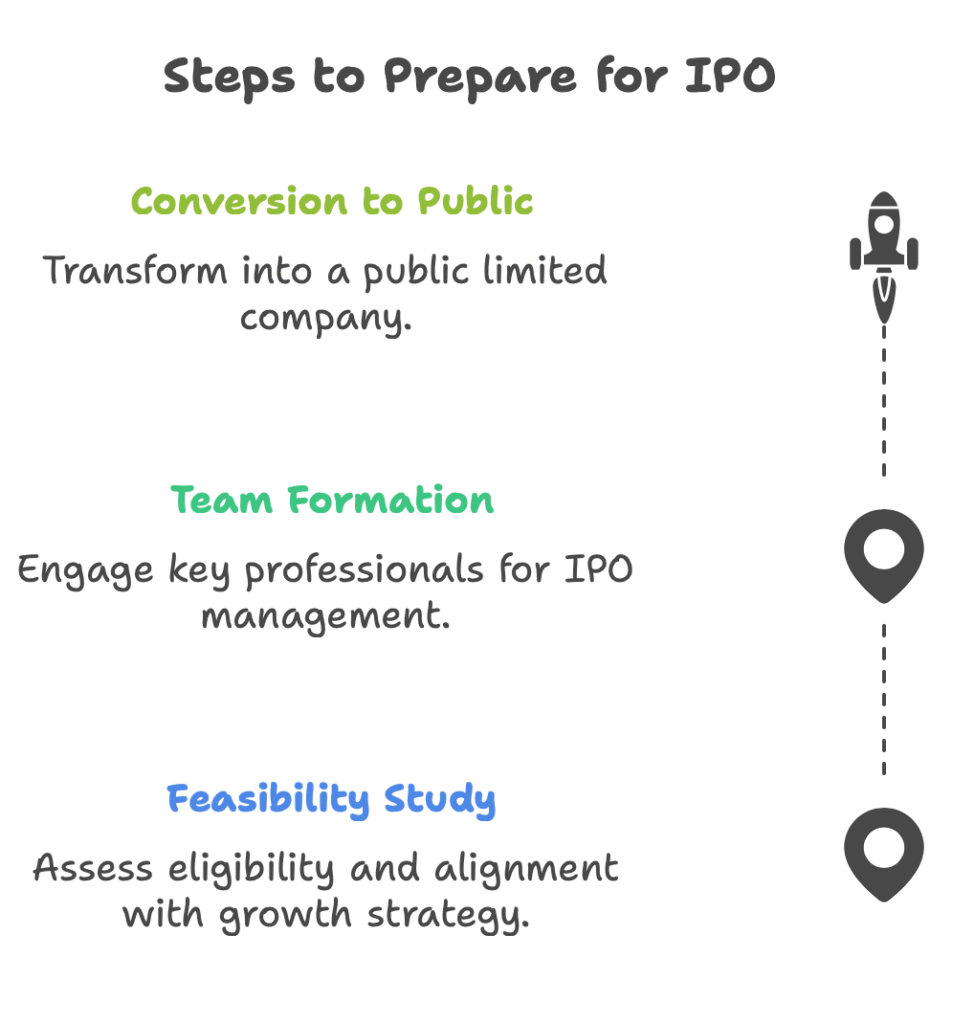

Company Structure:

- The company must be a public limited company incorporated under the Companies Act, 1956 or 2013. Private limited companies, partnership firms, or proprietorships must first convert into a public limited company to be eligible for an IPO. This is a critical requirement, as only public companies can issue shares to the public.

Track Record:

- The company, its promoters, or the promoting company must have a track record of operations for at least 3 years. This ensures the company has a proven business history.

- If the company is a converted entity (e.g., from a proprietary or partnership firm), the firm must have a minimum 3-year track record, ensuring continuity of operations.

- Promoters must have a minimum of 3 years of experience in the same industry and must collectively hold at least 20% of the post-issue paid-up equity share capital, ensuring promoter commitment.

Financial Criteria:

- Net Worth: The company must have a positive net worth, indicating financial stability.

- Operating Profit: The company must have operating profit (EBITDA) of at least INR 1 crore in 2 out of the last 3 financial years, demonstrating profitability.

- Net Tangible Assets: The company must have net tangible assets of at least INR 3 crore (for BSE SME) or INR 1 crore (for NSE Emerge) as per the latest audited financial results, ensuring asset backing.

- Free Cash Flow to Equity (FCFE): For NSE Emerge, the company must have positive FCFE for 2 out of the last 3 financial years, indicating cash flow generation.

Compliance and Legal Requirements:

- The company must not have any pending cases with the Board for Industrial and Financial Reconstruction (BIFR), insolvency, or bankruptcy proceedings, ensuring no financial distress.

- There should be no material regulatory actions against the company or its promoters in the past 3 years, maintaining a clean regulatory record.

- The company must not be involved in any litigation or criminal cases against its directors for serious crimes, ensuring governance standards.

- The company must facilitate trading in dematerialized form and have agreements with both Indian depositories (CDSL and NSDL), ensuring ease of share trading.

Cooling-Off Period:

- If an SME IPO application is rejected by the stock exchange, the company must wait for 6 complete months before reapplying, preventing frequent re-submissions.

For NSE Emerge Platform:

- Post-Issue Paid-Up Capital: Must be at least INR 1 crore but not exceed INR 25 crore, offering flexibility for smaller SMEs.

- Net Worth: The company must have a net worth of at least INR 1 crore, aligning with its lower capital threshold.

- Net Tangible Assets: At least INR 1 crore as per the latest audited financial results, ensuring minimal asset requirements.

- Track Record: The company must have been in existence for at least 3 years and have operating profit in at least 2 out of the last 3 fiscal years, focusing on operational history.

- Additional Requirements: The company must have a website and a board of directors with at least one independent director, enhancing transparency and governance.

For BSE SME Platform:

- Post-Issue Paid-Up Capital: Must be at least INR 3 crore but not exceed INR 25 crore, ensuring the company fits the SME definition.

- Net Worth: The company must have a net worth (excluding revaluation reserves) of at least INR 3 crore, indicating financial strength.

- Net Tangible Assets: At least INR 3 crore as per the latest audited financial results, ensuring asset backing.

- Track Record: The company must have distributable profits in terms of Section 123 of the Companies Act, 2013 for at least 2 out of the immediately preceding 3 financial years, emphasizing profitability.

- Additional Requirements: The list of promoters should not have changed in the preceding year from the date of applying for listing, ensuring stability.

Additional Notes:

- Offer for Sale (OFS): The OFS by selling shareholders should not exceed 20% of the total issue size, and selling shareholders cannot sell more than 50% of their holding, protecting existing shareholders.

- Special Cases: Microfinance companies must have at least 50% of their assets in microfinance loans, and broking companies must meet specific net worth and client fund requirements, reflecting sector-specific norms.

- Disclosures: The company must disclose material regulatory actions in the past 1 year, defaults in interest/principal payments in the past 3 years, litigation record, and criminal cases against directors for serious crimes, ensuring transparency.

Comparative Table: BSE SME vs. NSE Emerge Eligibility Criteria for Quick Comparison

| Parameter | BSE SME | NSE Emerge |

|---|---|---|

| Post-Issue Paid-Up Capital | At least INR 3 crore, ≤ INR 25 crore | At least INR 1 crore, ≤ INR 25 crore |

| Net Worth | At least INR 3 crore | At least INR 1 crore |

| Net Tangible Assets | At least INR 3 crore | At least INR 1 crore |

| Operating Profit (EBITDA) | Distributable profits for 2/3 years | At least INR 1 crore for 2/3 years |

| Track Record | 3 years, distributable profits | 3 years, operating profit in 2/3 years |

| Additional Requirements | No promoter change in last year | Website, 1 independent director |

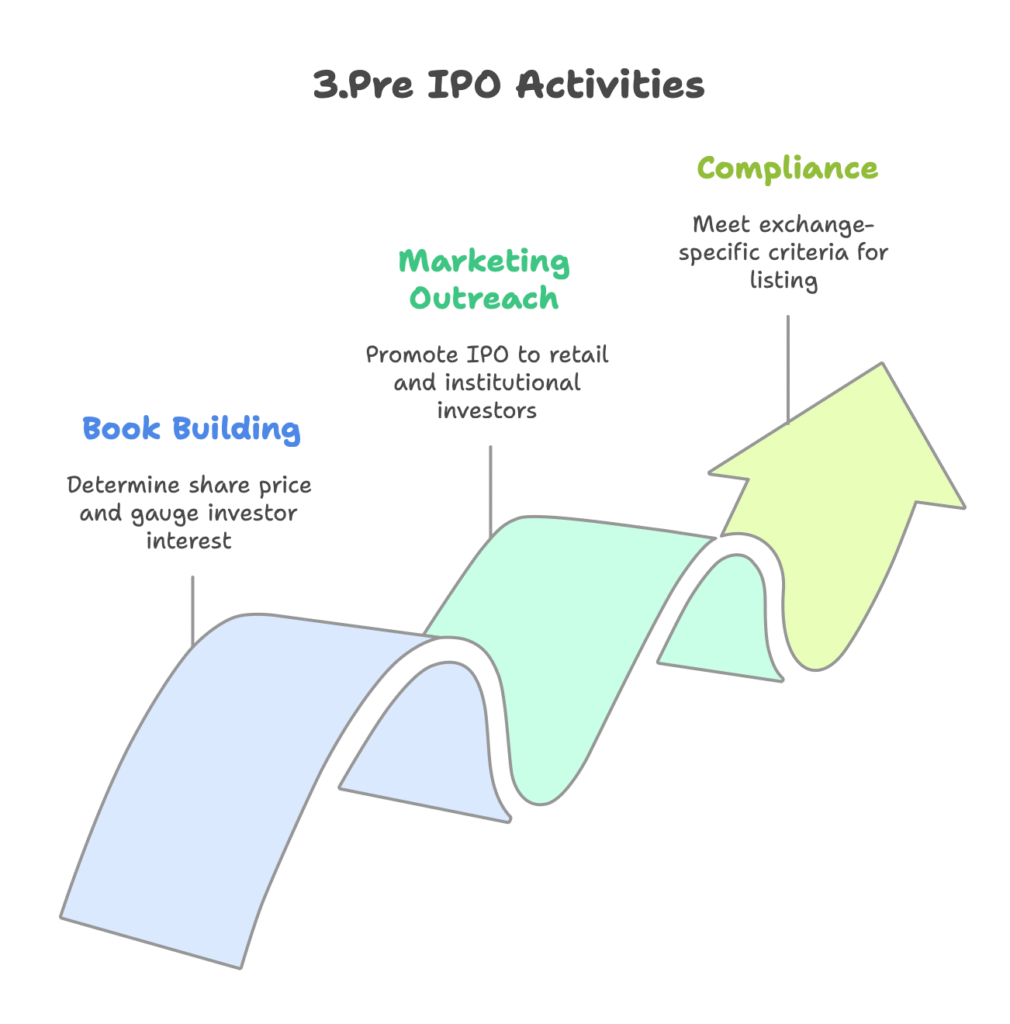

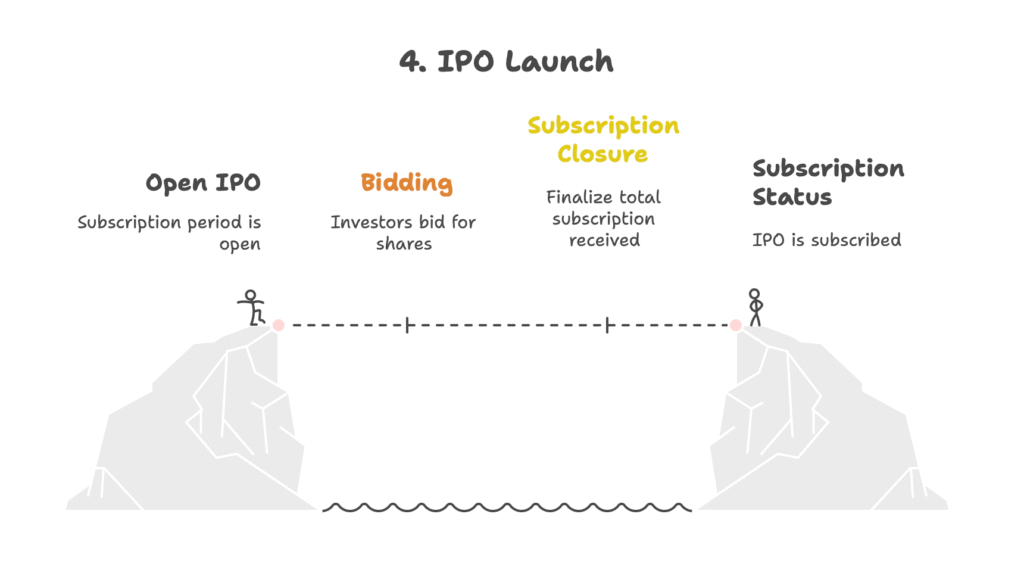

Subscription Period: Open the IPO for subscription for a specified number of days (typically 3-5 days), allowing investors to bid for shares.

Bidding: Investors bid for shares during this period, with the subscription level determining the success of the IPO.

Subscription Closure: Close the subscription period and finalize the total subscription received, assessing if the IPO is oversubscribed, undersubscribed, or fully subscribed.

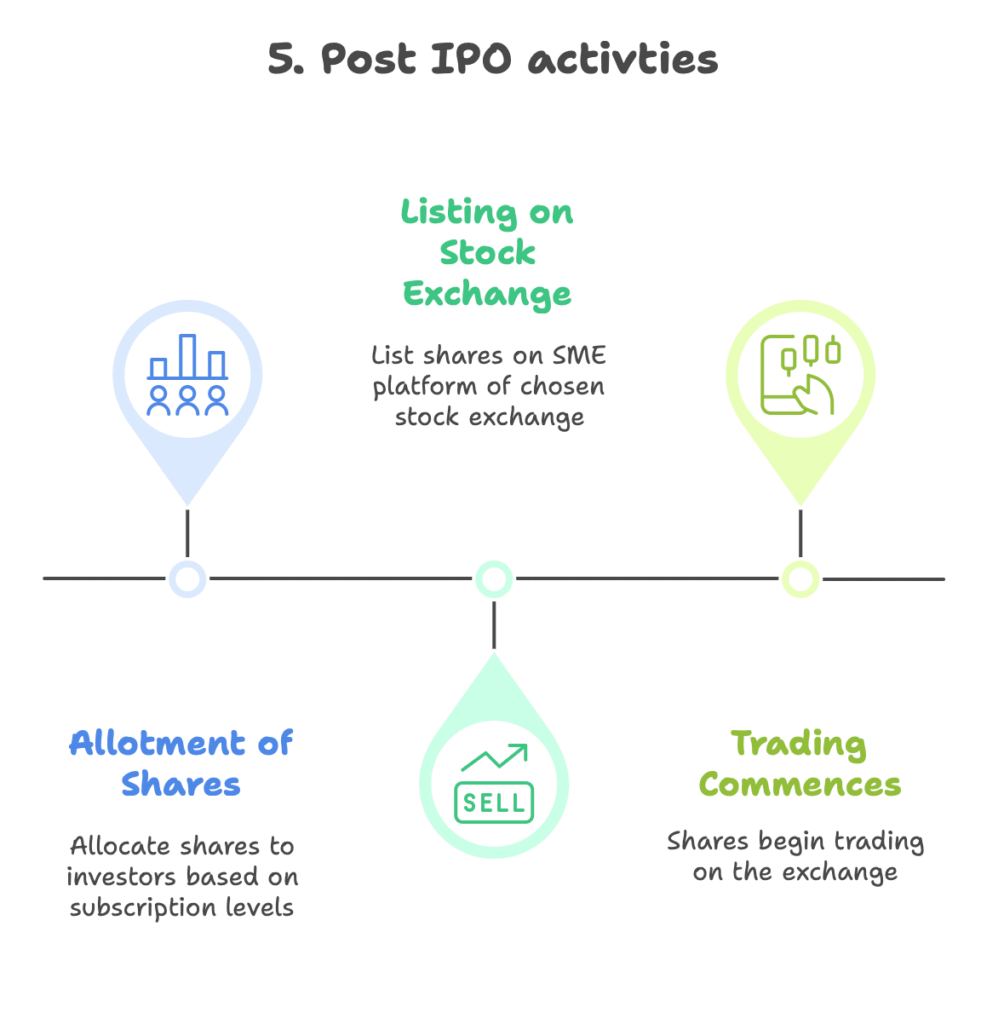

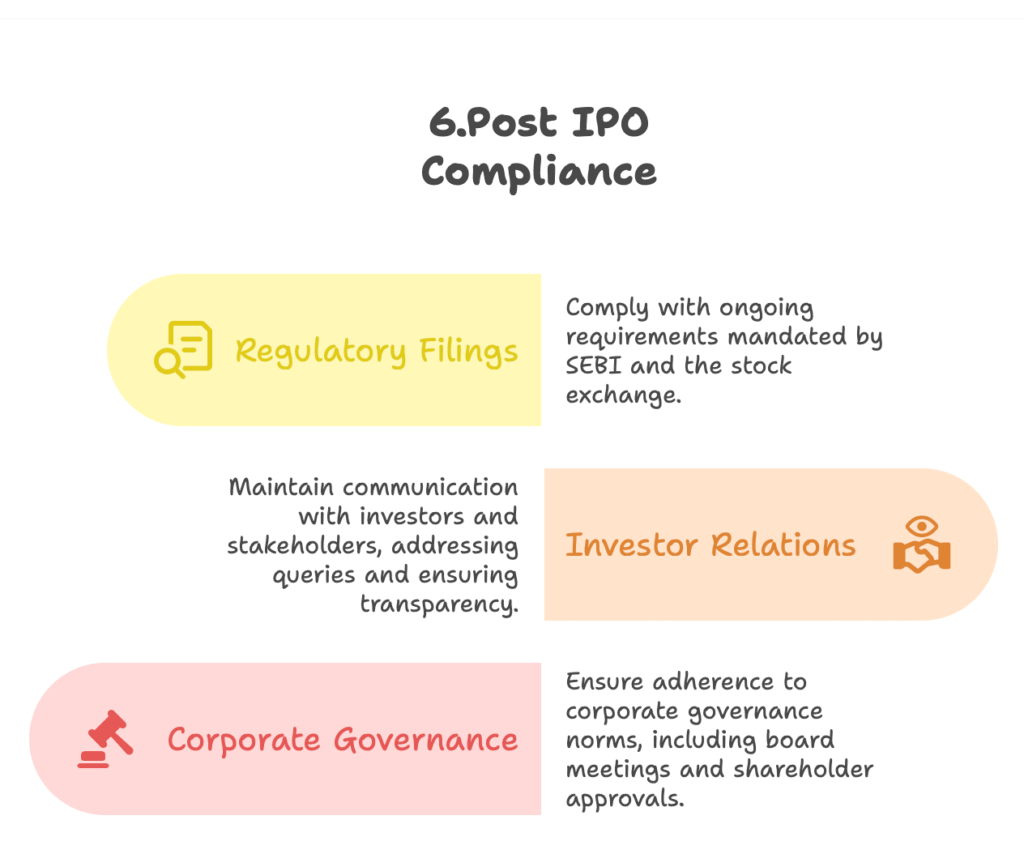

The eligibility for an SME IPO in India involves meeting specific financial, operational, and regulatory criteria set by SEBI and the stock exchanges. SMEs must have a minimum track record, positive financial metrics, and comply with legal and governance standards. The process from preparation to listing involves multiple stages, including documentation, regulatory approvals, marketing, subscription, allotment, and ongoing compliance, typically taking 3-6 months. By adhering to these criteria and following the structured flow, SMEs can successfully raise capital through an IPO, enabling them to fuel growth and expansion while enhancing their market presence.